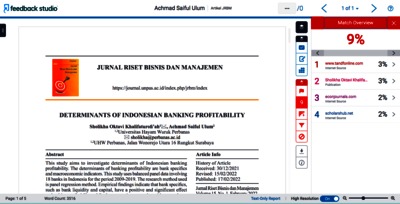

OKTAVI, SHOLIKHA and Ulum, Achmad Saiful (2022) Determinants of Indonesian Banking Profitability. Jurnal Riset Bisnis dan Manajemen, 15 (1). pp. 1-6. ISSN 2088-5091

|

Text

Jurnal Riset Bisnis dan Manajemen Sholikah_Ulum.pdf Download (878kB) | Preview |

|

![[img]](http://eprints.perbanas.ac.id/9511/2.hassmallThumbnailVersion/Turnitin.png)

|

Image

Turnitin.png Download (277kB) | Preview |

|

|

Text

Artikel JRBM_Turnitin.pdf Download (1MB) | Preview |

|

|

Text

PEER REVIEW artikel an Sholikha Oktavi_Vivi.pdf Download (233kB) | Preview |

Abstract

This study aims to investigate determinants of Indonesian banking profitability. The determinants of banking profitability are bank specifics and macroeconomic indicators. This study uses balanced panel data involving 18 banks in Indonesia for the period 2009-2019. The research method used is panel regression method. Empirical findings indicate that bank specifics, such as bank liquidity and capital, have a positive and significant effect on banking profitability, while the cost-to-income ratio and leverage has a negative and significant effect on banking profitability. The results of this study have considerable implications for policy. The government needs to regulate inflation, exchange rates, and interest rates. The results of this study can help policy makers, governments, bankers, and bank managers to better understand the various determinants of bank profitability. Keywords: bank specifics; macroeconomic; profitability; Indonesian banking; panel regression

| Item Type: | Article |

|---|---|

| Subjects: | 600 - TECHNOLOGY > 650 - 659 MANAGEMENT & PUBLIC RELATIONS > 658 - GENERAL MANAGEMENT > 658.15 - FINANCIAL MANAGEMENT |

| Divisions: | Lecturer |

| Depositing User: | Achmad Saiful Ulum |

| Date Deposited: | 04 Aug 2022 07:03 |

| Last Modified: | 08 Aug 2022 04:25 |

| URI: | http://eprints.perbanas.ac.id/id/eprint/9511 |

Actions (login required)

|

View Item |